Let’s go through the key changes, including:

- Purchase from EU Countries

- Sales to EU Countries

- Open Purchase & Sales Orders

- Shipment Method (INCO Terms)

- Tariff Codes & Import Duties

- Adding the EORI number

Explaining existing VAT Statements:

- You usually submit a VAT Return to HM Revenue and Customs (HMRC) every 3 months. This period of time is known as your ‘accounting period.’

- The VAT Return records things for the accounting period like:

Your total sales and purchases

The amount of VAT you owe

The amount of VAT you can reclaim

What your VAT refund from HMRC is - You must submit a VAT Return even if you have no VAT to pay or reclaim.

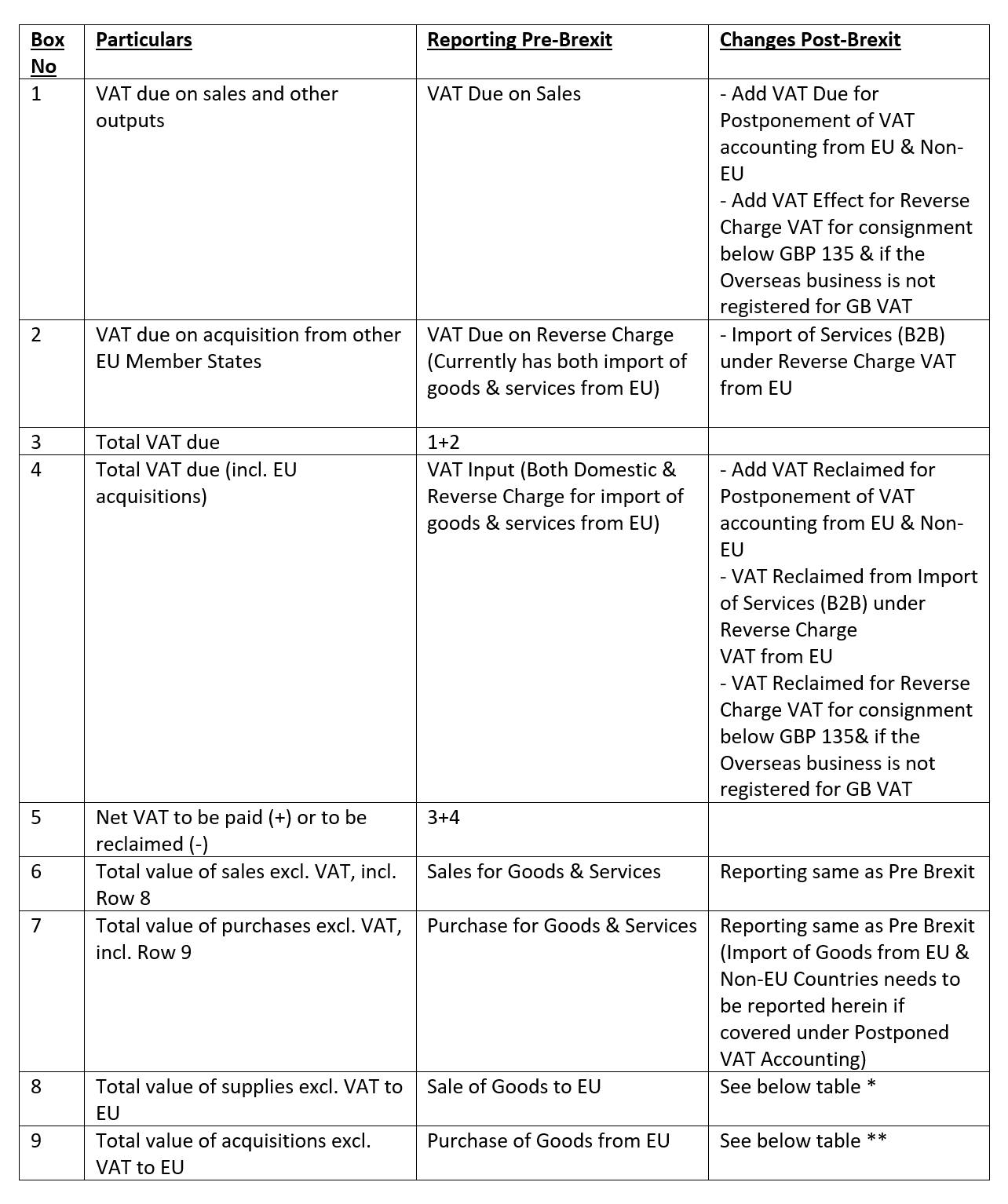

- VAT Return Statement includes declaration in following 9 boxes which show the pre Brexit and post Brexit changes:

* It needs to include only For supplies of goods and related costs, excluding any VAT, from Northern Ireland to EU Member States made from 1 January 2021

** It needs to include only For acquisitions of goods and related costs, excluding any VAT, from EU Member States to Northern Ireland made from 1st January 2021

1.) Acquisitions:

- Following Brexit, treatments of transactions having Acquisitions from EU countries & between Business-to-Business entities (B2B) will be changed from Intrastat to Import.

- Before Brexit came into effect, Reverse Charge VAT was applicable for Import of Goods & Services from EU Countries between Business-to-Business entities (B2B).

In the case of the acquisition of ‘Goods’ from EU & Non-EU Countries, ‘Postponement of VAT Accounting’ will be applicable Post Brexit.

(Please note that above rule is exclusively applicable for Import of Goods. Acquisition of ‘Services’ from EU, between Business-to-Business entities, it will continue to apply ‘Reverse Charge of VAT Accounting’ principle. I.e.no change in treatment for import of Services from EU Countries.) - Principle of application of ‘Postponement of VAT Accounting’ from newly added Monthly Statement to be downloaded from HMRC.

- Consignments valued at £135 or less: For imports of goods from outside the UK in consignments not exceeding £135 in value (which aligns with the threshold for customs duty liability), we will be moving the point at which VAT is collected from the point of importation to the point of sale. This will mean that UK supply VAT, rather than import VAT, will be due on these consignments.We can find more details on treatment of VAT for overseas goods sold on following links:

- To customers in Great Britain using online marketplaces from 1 January 2021

- Directly to customers in Great Britain from 1 January 2021

2.) Sales:

- Earlier in the case of B2B Sale to EU Customers, it was not subject to VAT provided the EU Customer is VAT Registered. Whereas in case of B2C Sale to EU Customers that was subject to 20% VAT.

- Subsequent to Brexit, treatment of Sale to EU Countries will be changed from intrastat sales to export sales.

- In the case of B2C, Sale to EU earlier applicable Distance selling threshold will go away & business needs to get themselves registered in respective EU countries as well.

- Sale to Northern Ireland from GB will be treated as Domestic Sales for VAT purpose & hence separate EORI Number for Northern Ireland is not required if selling to NI Customer via B2B or B2C.

Changes in VAT Business Posting Group, VAT Product Posting Group, VAT Posting Setup & VAT Statements

1.) Since treatment of VAT for Import from EU will be different for Import of Goods & Services, separate VAT Prod. Posting Group as ‘Service’ & continuing Reverse Charge VAT Posting setup thereof is essential for accounting of Import of VAT on services from EU Countries.

2.) Configuration for Postponement of accounting of VAT

In Navision/ NAV/ D365 Business Central, setup is required for accounting this VAT due & VAT Reclaimed for Import from EU Countries as well as ROW countries. In Order to do this new VAT Prod. Posting Group to be created as POSTPONED & VAT posting setup to be prepared for combination of VAT Business Posting Group ‘Blank’ & VAT Prod. Posting group ‘POSTPONED’ with VAT Posting Type as Full VAT.

Two New GL Accounts for ‘VAT Due on Import (Postponement)’ in Sales VAT Group & ‘VAT reclaimed on Import (Postponement)’ in Purchase VAT Group needs to be created with defaulting VAT Prod Posting Group ‘POSTPONED’ on them.

In General journal, a new batch can be created as ‘Postponed’ and to enable ‘Copy VAT Setup to Journal Lines’ option for the purpose of manually accounting Postponement of Import VAT based on monthly VAT statement for Import VAT as downloaded from HMRC.

In VAT Statements Box 1 & Box 4 ‘Postponed’ VAT amount needs to be added into.

3.) In the case of shipment of consignment imported from EU having low value (£135 or Less), the following 2 changes need to be made:

New VAT Prod Posting Group to be created as ‘Below’ & ‘Below Reverse Charge’.

Following 4 new VAT Posting Setup to be created as:

- 1.) VAT business posting group as EU & Vat prod Posting Group as Below (with Normal VAT on Purchase), VAT Rate as 20% This will be applicable if EU business is registered in GB VAT & is charging VAT.

- 2.) VAT business posting group as Non-EU & Vat prod Posting Group as Below (with Normal VAT on Purchase), VAT Rate as 20% This will be applicable if Non-EU business is registered in GB VAT & is charging VAT.

- 3.) VAT business posting group as EU & Vat prod. Posting Group as Below Reverse Charge (with Reverse Charge VAT), VAT Rate as 20%, This will be applicable if EU business is Not registered in GB VAT & has not charged VAT. Hence VAT is liable on Reverse charge.

- 4.) VAT business posting group as Non-EU & Vat prod. Posting Group as Below Reverse Charge (with Reverse Charge VAT), VAT Rate as 20%, This will be applicable if Non-EU business is Not registered in GB VAT & has not charged VAT. Hence VAT is liable on Reverse charge. VAT Statement to include Reverse charge VAT element in Box 2 & 4 respectively.

4) Furthermore, in many cases VAT Statement submission to HMRC involves pre-Brexit & post Brexit period. (for e. g. Nov to Jan return).

In such cases, it is highly recommended to create new VAT Business Posting groups (as EU-BREXIT), then map the same on Customer & vendor cards,

Mapping VAT posting Setup for new groups to incorporate VAT postponement accounting & changes to be made in VAT rates of VAT Posting Setup for sales made to EU B2C customers from 20% VAT to 0% VAT etc.

Once the above changes made on Customer & Vendor Card, the New VAT Bus. Posting Group will be populated on Orders, Shipment, Receipt, Invoices which are having posting date on or after 1/1/21. In turn revised VAT will be calculated as applicable.

If you added new VAT Business Posting Group BREXIT, you can create new combinations as VAT Business Posting Group BREXIT & Associated VAT Prod Posting Group on VAT statements. You should not change the existing VAT Posting combinations, otherwise there are chances of errors while processing VAT statements.

Alternatively, if you do not have split quarter VAT statements, you can change vat posting setups on 1/1/20 to start applying them on new documents from 1/1/20 for existing VAT Business Posting Groups only.

Changes on Orders:

Broadly, till 11pm on 31/12/2020, any shipments or receipts for which Custom declarations were not filled will carry old rules & while post that it will be on new rules. Hence, those open documents need to be handled after keeping following principles in mind:

i) For new orders created from 1/1/21 will carry new VAT Posting Setup, VAT calculation types & VAT rates.

ii) Orders that are not fully shipped or received need to be reopened , For Balance qty not received or shipped so far change new VAT business posting group on Order line & then process.( Pls note Existing warehouse shipment /receipt document needs to be deleted before that)

iii) Ideally, it has been recommended to complete the invoicing of Goods Received, Not Invoiced & Goods Shipped, Not Invoiced by invoicing them before changing VAT setup. You may contact your partner for help for these changes.

Changes in shipment Method:

– To have better visibility while doing Customs declarations, you need to review your business trade terms including INCO terms (International Commercial Terms) to check who is responsible for the customs declarations, trade documentation, licenses, and freight costs.

– You may need to add new INCO terms such as DDP (Delivered Duty Paid) in most of the commercial agreements & hence needs to be populated in Shipment Method of NAV as well.

Changes in Import Duty & Tariff Code:

– The negotiations on the Brexit deal formally ended on 24th December 2020 with an agreement approved in principle by the UK Prime Minister (on behalf of the UK) and the President of the European Commission (on behalf the EU).

– After the deal, import into UK will not have Import duty if covered under trade deal. However, it is mandatory to comply with appropriate custom declaration & include correct Tariff code in declarations.

– One needs to update correct Tariff code declared by HMRC in Navision/ NAV/ D365 Business Central.

The UK Global Tariff (check-future-uk-trade-tariffs.service.gov.uk)

– Import VAT from Non-EU Countries: Tariffs may continue to apply for Non-EU goods in the same way as they do today (WTO member (MFN – Most Favoured Nation terms)) & Import duty thereof needs to be accounted using Charge Item in NAV.

Adding the EORI Number:

– GB Business needs to get EORI No & hence add a field on Company Info & populate that no.

– Though it is not mandatory, it would be good practice to add the EORI number on Customer & vendor master & populate them Import/Export Documents, Invoices, Packing List etc.

When it comes to Business Central, Microsoft has incorporated EORI number & have published the following blog :

Brexit Impact on Business Central – United Kingdom leaving the European Union – Business Central | Microsoft Docs

Watch this space for more details on the impact of Brexit!

Feel free to contact us if you need any help or guidance: [email protected] OR [email protected]

+44 1908 508080

Jay Tahasildar, Mercurius IT: https://www.linkedin.com/in/jay-tahasildar-697955/