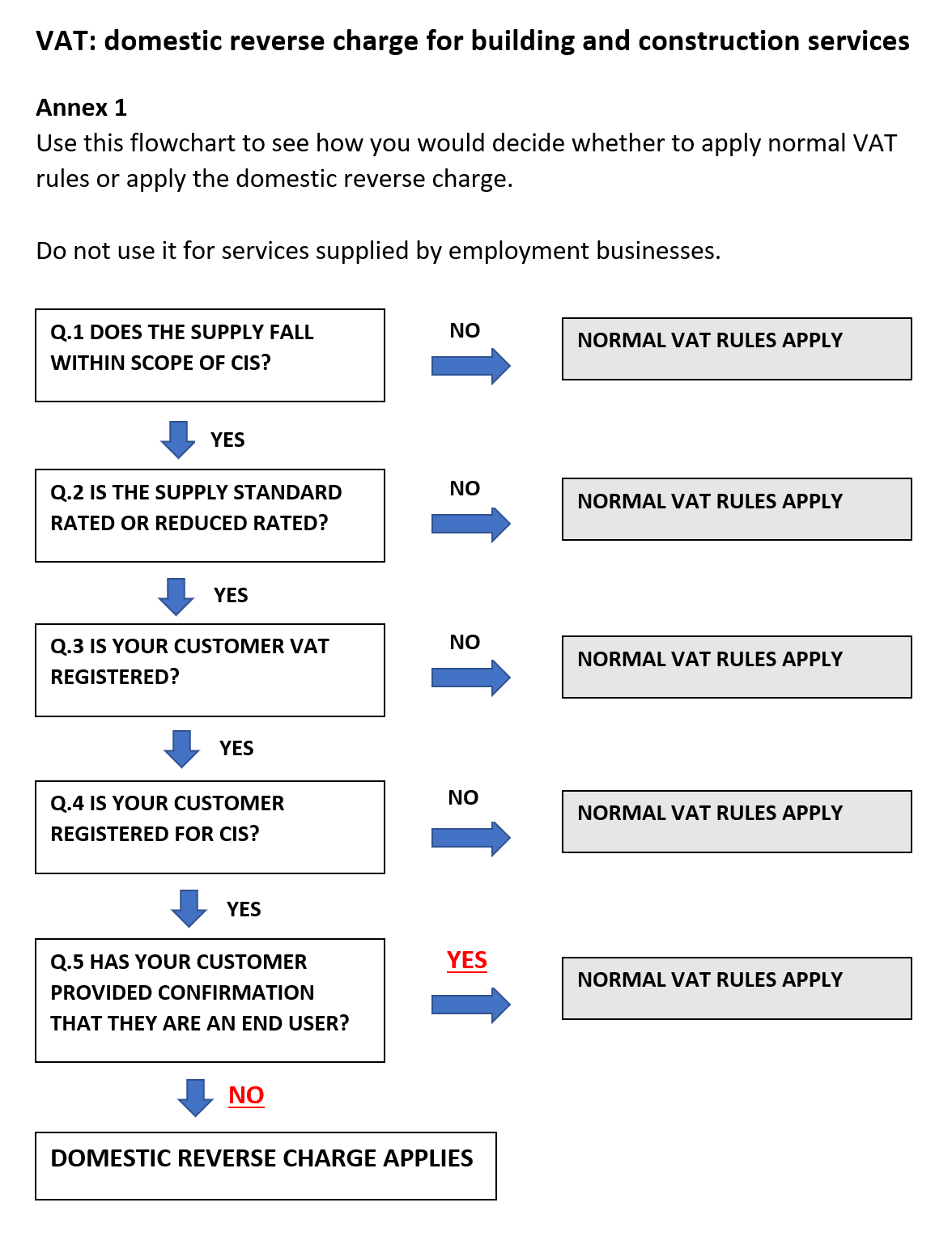

So, to start with, below is the flow chart which explains whether the Domestic VAT reverse charge must be used for your business. You need to sequentially assess the scenario and check whether the reverse charge VAT will be applicable for you.

To decide whether the supply to CIS-registered customers falls within the purview of CIS, important considerations must be made.

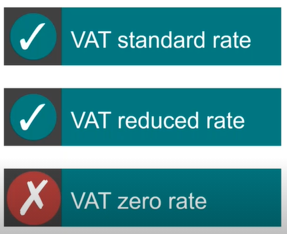

Generally, the following services provided to CIS-registered customers are applicable for the reverse charge of VAT:

– Construction, altering, repairing, or demolishing of building.

– Internal cleaning 0f building if it’s part of construction, alteration of repair work.

– Installing heating lighting drainage or similar system.

– Internal external painting or decorating of building.

– Construction, altering, repairing or demolishing any work foaming part of land – like walls, roadwork, or powerlines.

– Preparation or completion work of other specified services – Site clearance, excavation, landscaping etc.

Other CIS ‘Specified Services’ can be found on Construction Industry Scheme: a guide for contractors and subcontractors (CIS 340) – GOV.UK (www.gov.uk)

Alternatively, the customer may periodically issue a statement of CIS deductions which carries VAT registration details of customer.

Question 4: Is your customer is registered for CIS?

The web page below can be used to verify whether a customer is registered for CIS services:

Construction Industry Scheme (CIS) online service – GOV.UK (www.gov.uk)

Question 5: Has the customer has confirmed they are not the end user?

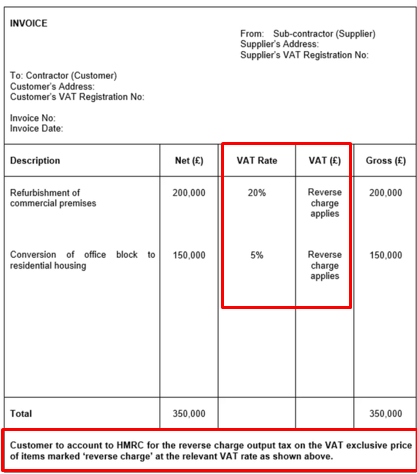

However, it is important that the sub-contractor displays either the VAT Rate OR VAT Amount that he is not specifically charging under Normal VAT.

Additionally, they may need to put the following note below invoice:

The following changes need to be made in Business Central OR Navision for contractors (customers) who are using sub-contractor (suppliers) services (if they are required to account for reverse charge VAT as mentioned in the conditions above):

1. Open New VAT Business Posting Group as Sub Contractor

2. Open New VAT Prod Posting Group for associated CIS Specified Services

3. Make Changes in VAT Posting Setup for combination of above two with VAT calculation Type as Reverse Charge

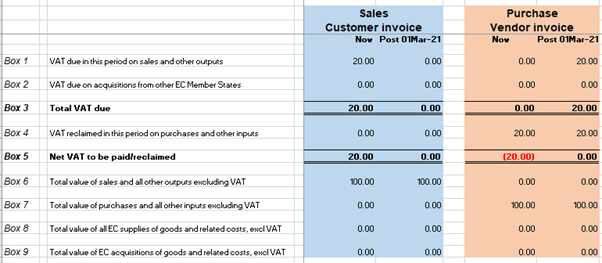

4. Map the above combinations in VAT statements for submission to HMRC, using Making Tax Digital as follows:

(1.) Change in Box 1: VAT due in this period on sales and other outputs (For Vat liability)

(Please note since this is domestic reverse charge VAT the liability thereof to be covered under Box 1 instead of Box 2)

(2.) Change in Box 4: VAT reclaimed in this period on purchases and other inputs (for reclaiming VAT liability mentioned in Box 1)

To summarise, the table below explains representation on VAT statement changes in Sub-Contractor (Seller) & Contractor (Purchaser) Books:

And so, contractors will start calculating the reverse charge on all purchase invoices accounted on or after the 1st of March. This will be for CIS specified services purchased from their sub-contractor and will also be accounted as a liability in the books of the contractor’s accounts.

If you still need information to check what is applicable for your business, read the information here:

From 1st March 2021 the domestic VAT reverse charge must be used for most supplies of building and construction services.

You can also read about our CIS automation module for Business Central and Microsoft Dynamics NAV.

Or contact us so we can discuss HMRC compliance straight away!