Embarking on a journey towards financial excellence requires businesses to embrace cutting-edge solutions that redefine traditional practices. Bank reconciliation stands as a linchpin in financial management, ensuring the accuracy of records by harmonizing internal data with that of the bank.

Microsoft Dynamics 365 Business Central, a market-leading Enterprise Resource Planning (ERP) solution, takes a giant leap forward in this realm by introducing Microsoft’s Copilot – an advanced AI tool poised to revolutionize the bank reconciliation process.

In this blog post, we dive into the transformative capabilities of Copilot, exploring how it reshapes the financial management landscape within Business Central.

As the demand for precision in financial operations intensifies, the integration of Copilot emerges as a strategic move, aligning businesses with the future of AI-driven efficiency and accuracy.

Understanding Copilot in Business Central

Before delving into the enhanced bank reconciliation features, let’s gain a deeper understanding of Copilot. Microsoft’s Copilot is a cutting-edge AI tool that provides a user-friendly chat experience, enhancing productivity, creativity, and information comprehension.

Seamlessly integrating with your data through Large Language Models (LLMs) in a secure and privacy-preserving manner, Copilot transforms into a robust productivity tool. Through its integration with Microsoft 365 and Dynamics 365 apps, Copilot offers a chat interface for quick summaries of sales opportunities, updates, meeting preparations, and more.

Crucially, Copilot adheres to GDPR and EU Data Boundary, aligning with Microsoft’s commitment to privacy, security, and compliance.

Existing copilot features in BC

In the previous Release Waves in 2023, Microsoft began integrating Copilot functionality into Business Central, facilitating tasks such as effortlessly generating product marketing descriptions. You can see the functionality in action here. Additional AI capabilities already available include inventory forecasting and late payment prediction.

We anticipate a range of new Copilot functionalities in the upcoming Release Waves of April and October, ushering in the era of conversational ERP.

A standout feature in the 2023 Release Wave 1 is ‘Chat with Copilot’, allowing users to interact with the chat interface using natural language to execute actions and commands within Business Central.

Discover more about this exciting new functionality in our dedicated blog post.

Key features of Copilot Bank Reconciliation:

When it comes to bank reconciliation, Copilot emerges as a valuable ally by automating and guiding users through the process.

Leveraging machine learning and artificial intelligence, Copilot offers proactive assistance with key features:

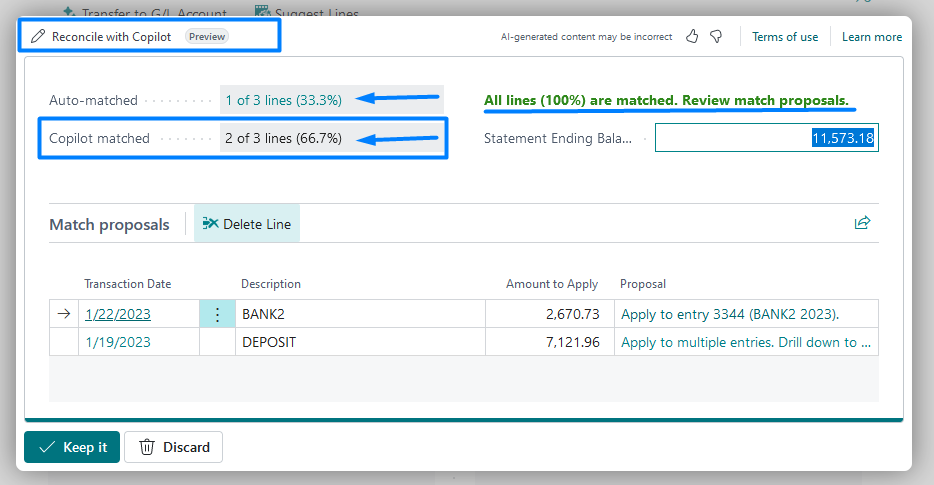

- Automated Matching: Utilising pattern recognition, Copilot automatically matches transactions between the company’s records and bank statements.

- Suggested Matches: The tool suggests potential matches for unmatched transactions, reducing manual effort and accelerating the reconciliation process.

- Learning Capabilities: Copilot learns from user behaviour, enhancing accuracy over time by adapting to the organization’s unique transaction patterns.

How to use Copilot for Bank Reconciliation

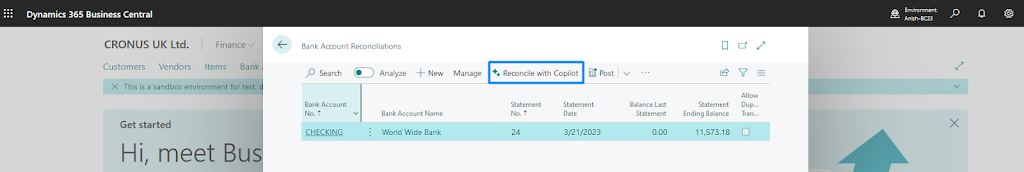

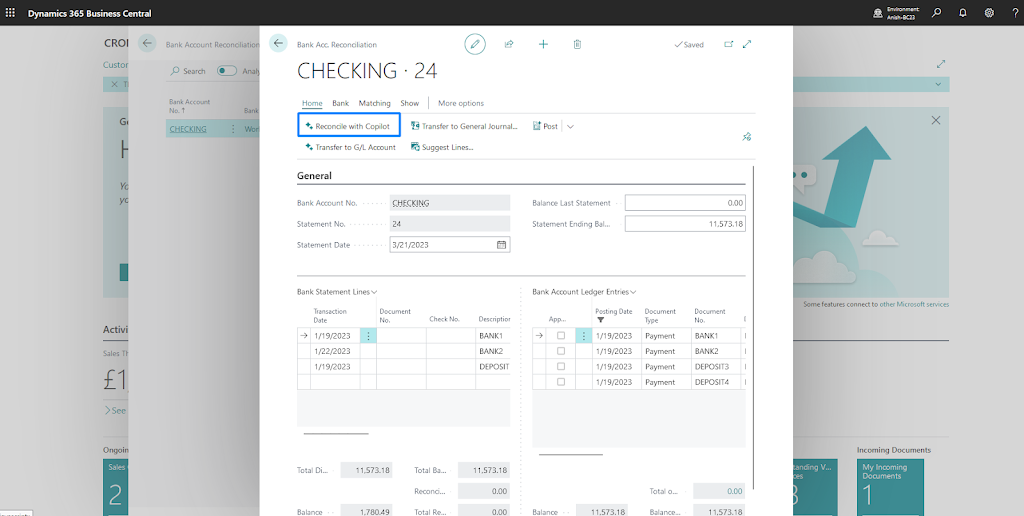

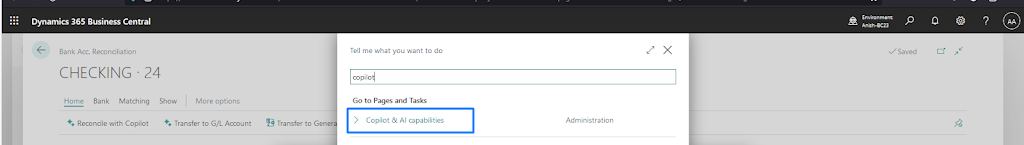

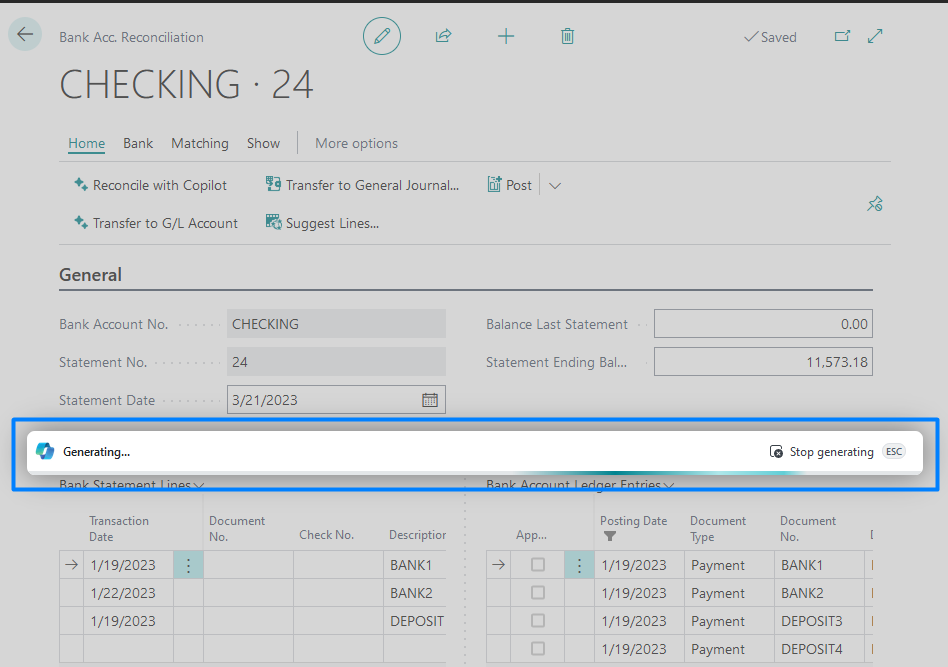

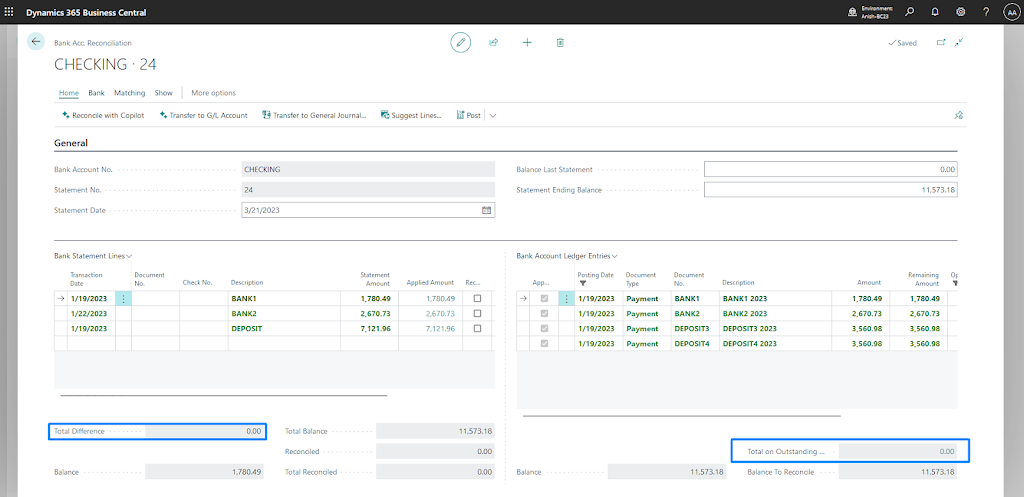

1: Access the Reconciliation Worksheet: Navigate to the Bank Account Reconciliation page in Business Central to access the reconciliation worksheet.

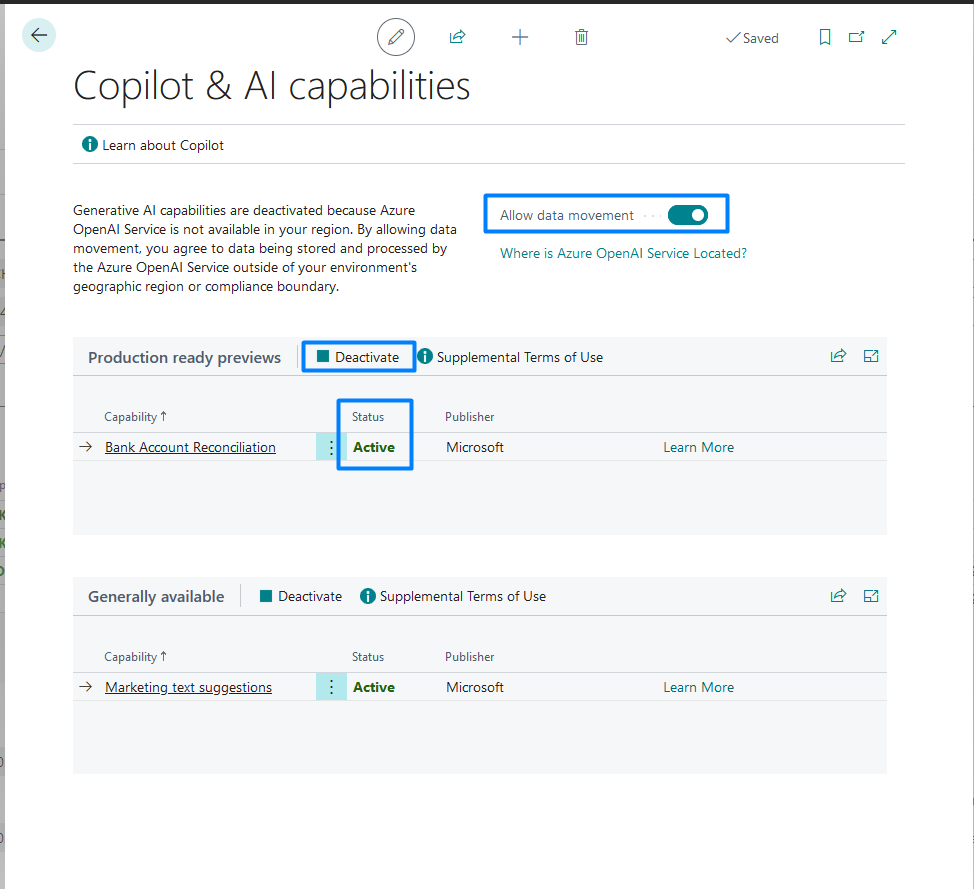

2: Enable Copilot: Ensure that Copilot is enabled for the specific bank account by selecting the option in the Bank Account Reconciliation page

3: Review Suggestions and Matches: Copilot will automatically suggest matches for unmatched transactions. Review the suggestions and confirm matches to update the reconciliation status

4: Exception Handling: Focus on exceptions and discrepancies that Copilot may not have automatically matched. Resolve these exceptions manually, which will provide additional insights for Copilot’s continual learning process.

5: Finalise Reconciliation: Once the reconciliation is complete, finalise the process, and generate reconciliation reports for record-keeping purposes.

Bank reconciliation is a pivotal aspect of financial management, and Copilot in Microsoft Dynamics 365 Business Central elevates this process to new heights of efficiency and accuracy.

By harnessing the power of machine learning and automation, Copilot transforms the bank reconciliation experience, empowering finance professionals to work more strategically and make better-informed decisions.

As businesses pursue financial precision, embracing Copilot for bank reconciliation in Business Central becomes a strategic move towards achieving financial harmony and streamlining day-to-day financial operations.

Simplify Dynamics 365: Financial Management with Copilot

Get in touch with one of our specialist and make use of its expertise for an hour with our free consultation call.

We are available for any Microsoft Dynamics 365 users, whether you are one of our clients or not.

Elevate Your Financial Management with Copilot

Transform your financial operations with Copilot in Microsoft Dynamics 365 Business Central. Experience the efficiency and accuracy of automated bank reconciliation, paving the way for strategic financial decision-making. Embrace the future of conversational ERP.

Connect with Mercurius IT for innovative solutions and personalized support. Reach out to us today and let’s elevate your business together!