The Construction Industry Scheme (CIS) was introduced by HMRC for those who are self-employed (subcontractor) in the construction industry working for a contractor, but not as an employee. CIS rules declare that contractors are obliged to deduct money from a subcontractor’s payments (20% if registered, 30% if unregistered) and pass it to HMRC. These deductions count as advanced payments towards the subcontractors’ tax and National Insurance. The CIS was developed to provide HMRC with an upfront payment and reduce the administrative burden on subcontractors.

Worked covered by CIS

CIS covers most construction work:

- A permanent or temporary building or structure

- Civil engineering work like roads and bridges

For the purpose of CIS, construction work includes:

- Preparing the site, e. g. laying foundations and providing access works

- Demolition and dismantling

- Building work

- Alterations, repairs and decorating

- Installing systems for heating, lighting, power, water and ventilation

- Cleaning the inside of buildings after construction work

Automating your CIS payments & compliance

Why automate your CIS Payments?

Having spoken with businesses who are currently manually processing their CIS payments, we understand this process can be longwinded and time-consuming. This is why we developed Mercurius Construct CIS, to help you easily verify subcontractors, process all your CIS deductions, payments, returns, statements & compliance from Dynamics 365 Business Central ERP.

Feature highlights of Mercurius Construct CIS

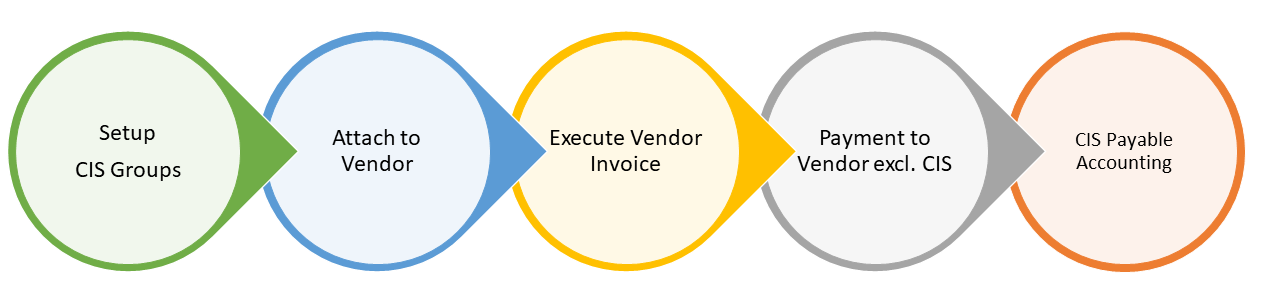

Our solution, built on Business Central, automates the payment and accounting aspects which CIS invoices from subcontractors.

- It allows you to verify Subcontractor Details, and submit the HMRC monthly return [Form MCIS300].

- The module also has the facility to validate the CIS registration number [UTR] of the vendors with HMRC portal. All subsequent transactions (Invoice/ Credit Memo) from vendors will automatically trigger the CIS tax accounting in the system.

- It has its own subledger, giving you an overview of all the CIS tax withholding details.

- Generate your CIS tax Monthly Return Summary directly from the system as and when required.

- In addition, you can receive support for CIS Returns Processing, there are transactional triggers for CIS Tax Accounting in the system, and extended reporting and analytics is available.

- It facilitates CIS interim liability accounting at the time of booking the purchase invoice and CIS Interim liability transfer to CIS Payable Account on payment of purchase invoice.

CIS Process Steps in Business Central

Why choose Mercurius Construct CIS?

We are proudly verified by HMRC as a commercial software supplier for our CIS solution, giving you confidence that Mercurius Construct CIS can handle all aspects of your CIS process.

- Our solution expedites the time-consuming manual processes around CIS compliance into an easy to follow, automated process within Business Central itself.

- Generate monthly CIS Tax Return Summaries.

- Option for extended reporting and analytics.

We hope this blog post has given you some insight into our CIS solution and how it can significantly reduce the time it takes to process your CIS compliance. For any further information or to arrange a demo to see the solution in action, please leave your details in the contact form below.

Want to see a demo of the solution in action?

Leave your details in the contact form to get started.