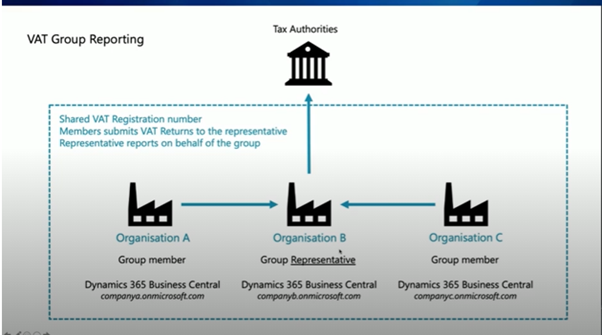

What is Group VAT?

1) When Two or more companies or limited liability partnerships – known as ‘bodies corporate’ – can register as a single taxable person or VAT group if:

• each body has its principal or registered office in the UK

• they are under common control – for example, one or more company is a subsidiary of a parent company

2) A VAT group is treated in the same way as a single taxable person registered for VAT on their own. The registration is made in the name of the ‘representative member’, who is responsible for completing and submitting a single VAT Return and making VAT payments or receiving VAT refunds on behalf of the group (more specifically ‘Members’ of the group).

3) Summarily once Group VAT Registration is obtained, 9 boxes of VAT Returns can be aggregated at group level and a single statement for group level (as Group Representative) will be submitted to HMRC covering VAT details of Group Members.

Group VAT and Business Central

1) Setup VAT Group Representative: we need to setup VAT Group Representatives from VAT Group Management Option in Assisted Setup in the Representatives Company.

2) Setup VAT Group Member: we need to setup VAT Group Member from VAT Group Management Option in Assisted Setup in the Representatives Company. Group Member will establish Member Connection with their Group Representative.

Company which has Group Member will contact their VAT Group Representative in BC with the following information:

i) API URL of the Group Representative:

https://api.businesscentral.dynamics.com/v2.0/[TENANT-ID]/[ENVIRONMENTNAME].

For example, https://api.businesscentral.dynamics.com/v2.0/907869c3-b252-4aca-b9cb-17a15d25477b/UKRepresentative.

ii) Group Representative Company Name

iii) Authentication Type: OAuth2

Please make note of Group Member ID generated at this stage.

3) Group member ID generated for Group Member Company needs to be updated in Group Representative company, so that they will make the Group member as “Approved Member of the Group”

Creating Group VAT Return

1) Prepare VAT Return by Group Members:

VAT group members use the standard processes to prepare VAT returns in their own companies.

The only difference is VAT Group member to choose the VATGROUP report version in VAT Return Card while submitting the VAT return. This means VAT return will be submitted by VAT Group Member to the VAT group representative rather than to the HMRC.

Once the group member has submitted the return, it will be available in “VAT Group Submissions” Page in the books of Representative Company.

2) VAT Group Submission Page:

The VAT Group Submissions page lists the VAT returns that members have submitted.

The page serves as a draft location for the submissions until the VAT group representative includes them in a VAT return for the ‘group’.

User can open the submissions to review the VAT for the individual boxes reported by the VAT group member.

3) Creating Group VAT Return:

To report VAT on behalf of the group, on the VAT Returns page in Representative books, Create a VAT return for Group Representative’s company only.

Afterward, include the most recent VAT submissions from VAT group members by choosing the Include Group VAT action.

4) Once the VAT Group representative’s VAT Return has been submitted to the authorities on behalf of the entire group, it will normally run the Calculate and Post VAT Settlement action in Representative Company Books.

Once the Group VAT Return is submitted, User can run the Calculate and Post VAT Settlement action in VAT Group Member’s Company Books.